Solana DeFi had been on a strange ride in 2022. Innovative protocols were built, on the solid foundation of the Solana Network - high throughput, fast finality, and cheap fees. It has also gone through periods of lows, including a myriad of exploits and edge cases. With 2023 already having big leaps, here is the recap of all the interesting actions across Solana DeFi.

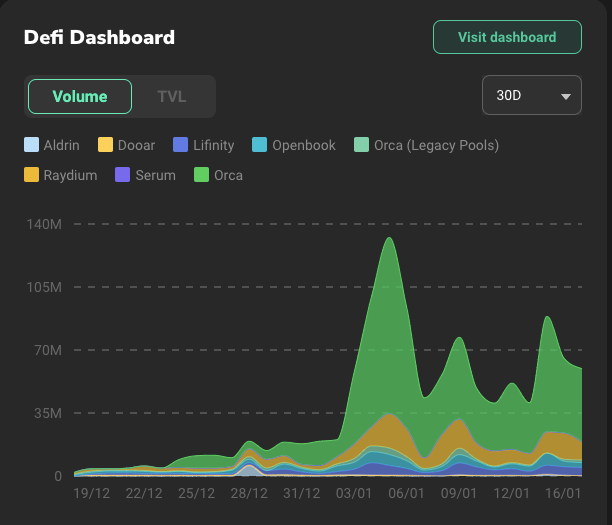

Network Overall View:

The collapse of FTX and Alameda has been a hit to Solana DeFI, with TVL dropping significantly, from 961 Million in November to 228 Million in the last days of the year. The price of SOL, in the same period, also went down to 9.75, a 74.8% decrease.

Big Trends

Despite the general sentiment, innovation and grassroots activities still occur across the ecosystem. Here are a few trends for us to see so far:

Spot DEX:

One of the major catalysts for Solana Defi, and a point of attraction for activities in the space, is the utilization of CLOB on-chain, through Project Serum. CLOB, or Central Liquidity Order Book, allows traders to have a CEX-like experience in a decentralized manner.

With the downfall of Serum, Orca has become the dominant trading DEX for Solana, taking in over 63% of the total swap volume. A more detailed overview of major DEXes and how they perform, based on various metrics, such as TVL and Trading Volume, can be accessed here, at the front page of Solscan, via our DeFi dashboard.

As we navigate the ecosystem post-FTX, others have taken the reign to replicate and rebuild CLOB mechanisms on-chain, with stand-out projects tackling this are OpenBook, Ellipsis, and Lifinity. Let's get into the details for each of these:

OpenBook

Openbook is a community fork of Project Serum to rebuild the protocol from scratch. This is due to FTX having upgradable authority for Project Serum's program, which can pertain to security risks given the exchange's downfall. The project was rebuilt by top developers in the ecosystem, with integrations already in the work, including Jump. It would be interesting to see how the new CLOB will take shape, given that this is a community effort, and there are different paths to improve and upgrade.

One major catalyst on its roadmap is the utilization of token models, as there have been debates surrounding the protocol as a business and forms of contributor rewards for rebuilding such a crucial public good.

Ellipsis:

Ellipsis Labs is the team behind Phoenix DEX, intending to be the liquidity backbone of Defi, built on top of Solana. Professionals now can provide liquidity in a sophisticated and high-fidelity way, enabling tighter and deeper liquidity. Capital efficiency, profitability, and sustainability for market makers are the names of the game.

Here are some technical features from Ellipsis to be excited about, mainly leveraging Solana's technology:

Instant settlement

Highly composable, and able to fit more instruction in a single transaction

On-chain market events, easy for traders to know the live state of their books and orders.

With devnet coming soon in 2023, and an active presence on Solana DeFi, we look forward to the new on-chain experience that would fulfill the goal of Decentralized Finance on Solana

Lifinity:

Lifinity is the first proactive market maker on Solana, designed to improve capital efficiency and reduce impermanent loss. The protocol achieves this by utilizing the following innovative mechanisms:

Liquidity concentration: Instead of LPs providing liquidity for tokens across the price interval (0, infinity), they only provide to a specific range, where most trades take place. This ensures a higher share of trading fees, and thus makes LP capital efficient.

Oracle utilization: Lifinity’s oracle is used as the key pricing mechanism, instead of relying on a pool’s balance of assets. This eliminates the reliance of arbitrageurs to adjust the price, reducing or even reversing impermanent loss for the market maker. The oracle uses Pyth Network’s high-fidelity data market to know the price of assets on other exchanges. With this, the protocol can buy low and sell high, in order to reverse impermanent loss and be more profitable rather than just holding the asset.

Rebalancing: The protocol rebalances its pools by adjusting their liquidity, thus creating the simplicity of standard of constant product pools where the total value of each asset in a pool is always equal. When an asset X comprises less than 50% of the total value of the pooled asset, the market maker will decrease liquidity for buyers of X and increase liquidity for sellers of X. This helps incentivize traders to sell against the pool, while discouraging buying, and as a result, the pool balance regresses to the bonding curve.

The usual big names in the space, such as Orca, are also having plans to bring CLOB as part of the product development. Under Solana's unique technical design, both CLAMM and CLOB are viable design patterns, suitable for continuous adoption and development. It’s also arguable that CLAMM is an innovation above CLOB, given the flexibility of path independence, as reasoned by Yuri from Orca in this tweet

Structured products:

Perpetual and Options product seems like the next development for DeFi, given that they enjoy a far greater tailwind for risk appetite. Building decentralized toolkits for active trading, however, is a hard and monumental task, given the problems with liquidity fragmentation, in-time settlement, collateral availability, and the spread/slippage between various markets.

Let's take a look at some protocols, and solutions that are tackling this space:

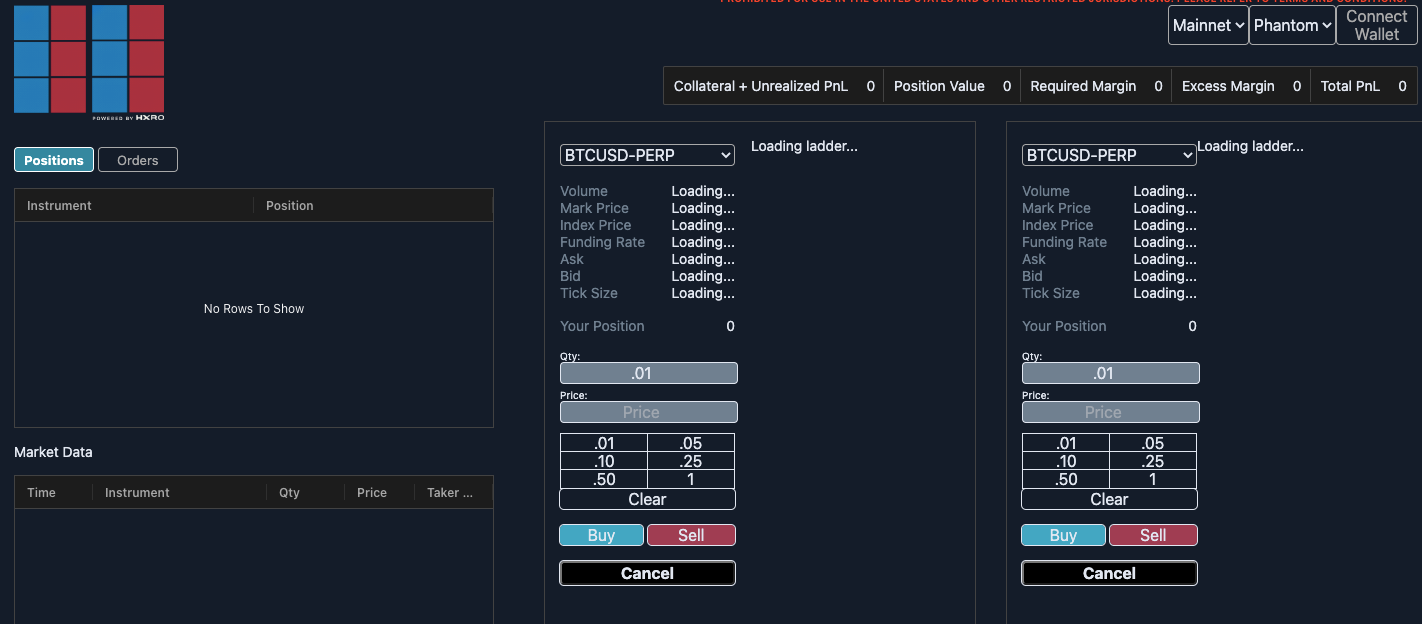

Hxro Network:

Hxro is an on-chain derivatives primitive for risk-based applications built on the Solana blockchain. Through a series of native protocols, Hxro provides the framework and infrastructure for a robust, fully-functional decentralized exchange for derivatives (futures and options) and parimutuel contracts.

You can think of Hxro as CME, but for DeFi, with a host of tools and financial instruments all functioning under one roof. The protocol is made up of various elements that are built natively on top of Hxro or through partnerships with other prominent Solana protocols.

A unique feature of Hxro Networks is that its components can be modular and implemented across a wide variety of systems, making it a unique building block for the derivatives market on Solana. With partnerships already in the work, such as Convergence RFQ, and community initiatives, such as OpenHxro, we look forward to seeing more integration and robust ecosystem built out, leveraging Hxro's unique design.

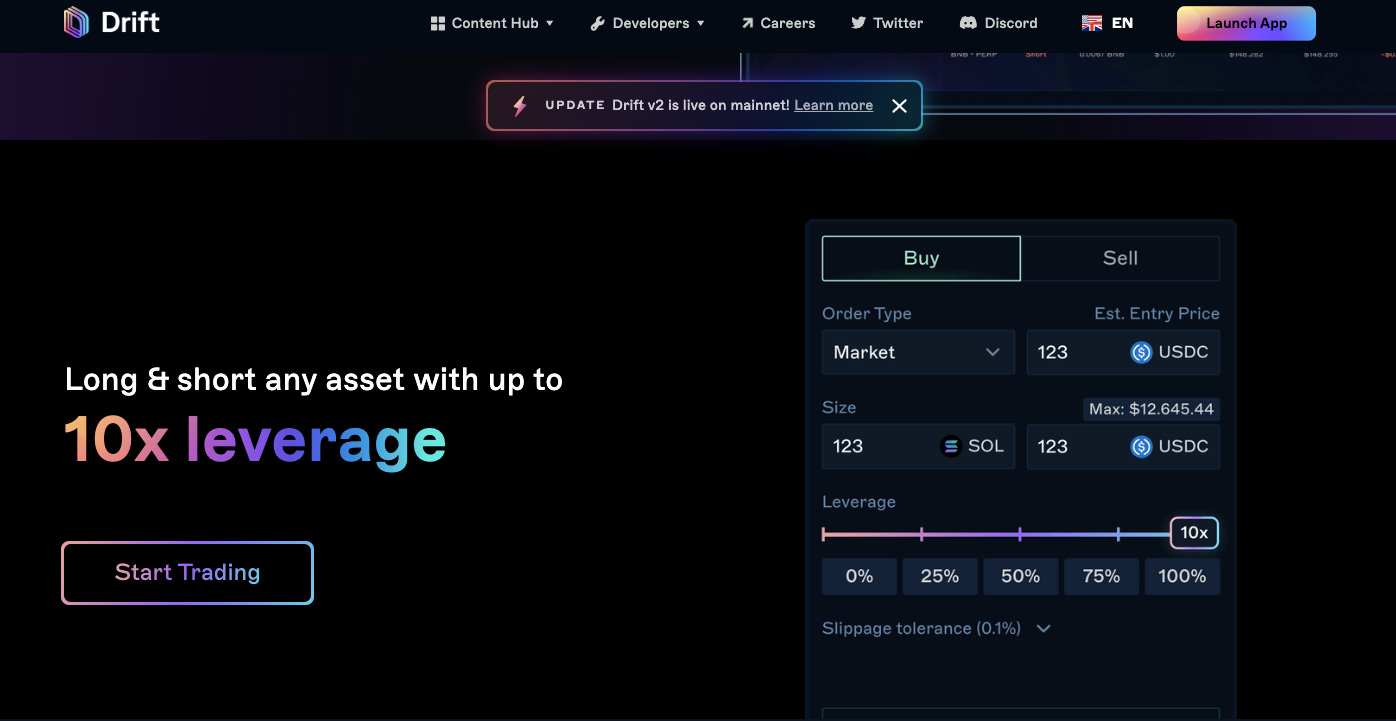

Drift Protocol:

Drift Protocol is a decentralized exchange that supports low slippage, low fees, and minimal price impact on all trades. Understanding the inefficiencies of bringing the tradfi centralized liquidity engine on-chain, Drift Protocol was designed with specific implementations in mind:

JIT-liquidity: all market orders are routed to short-term Dutch Auction that can be competed for fill by market makers. at or better than the auction price.

Constant Liquidity: Drift's virtual AMM is the designated backstop liquidity that traders can take from if orders are not filled by JIT, and resting orders can be filled by the AMM. The AMM is inbuilt with a bid-ask spread system that adjusts based on the inventory being held.

DLOB: Orderbook is the third source for Drift's liquidity, in which the on-chain orders placed by users are matched with off-chain order monitors by Keeper Bots. These bots have their view of the order book, oracle, and the availability of the AMM, and as such allow traders to have their trade executed with low slippage and deep liquidity.

Building towards real-world adoption:

Real-world mass adoption with crypto still feels like a meme, and frankly too nascent. With the market driven by hype and high valuations, it's possible to turn a blind eye. To bring true adoption, it is important to explore avenues of tokenization and permissioned finance, and allow for greater integration between on-chain assets and off-chain businesses. We believe the compromisation help brings greater composability while letting liquidity and innovations flow more freely.

Tokenization of assets:

As we have seen with the traditional market, more and more assets are being represented digitally. The world is turning increasingly cashless, and blockchain now presents a way to digitize assets further down the curve, while still preserving their value.

Asset tokenization allows for financial incentives and improves liquidity across a wide range of assets. With many vehicles considered long-term investments and financing, such innovation is needed to truly enhance composability while retaining ownership across the board.

The project that standouts for us in this category is Parcl

Parcl is a new protocol that allows you to get perpetual exposure to synthetics asset using an AMM architecture, allowing users to trade the price movement of real estate assets around the world.

The newly released v2 borrows from both traditional AMMs and synthetic asset protocols to produce an efficient and simple synthetic asset AMM. The key features let Parcl offers solvency, zero credit risk, capital efficiency, and price execution at oracle prices.

As the project continues to expand its offerings and work on issues, such as liquidity fragmentation and oracle pricing updates for real estate markets, we believe the future for the project is exciting, given the tailwind on tokenized assets.

Real-world asset and permissioned onboarding:

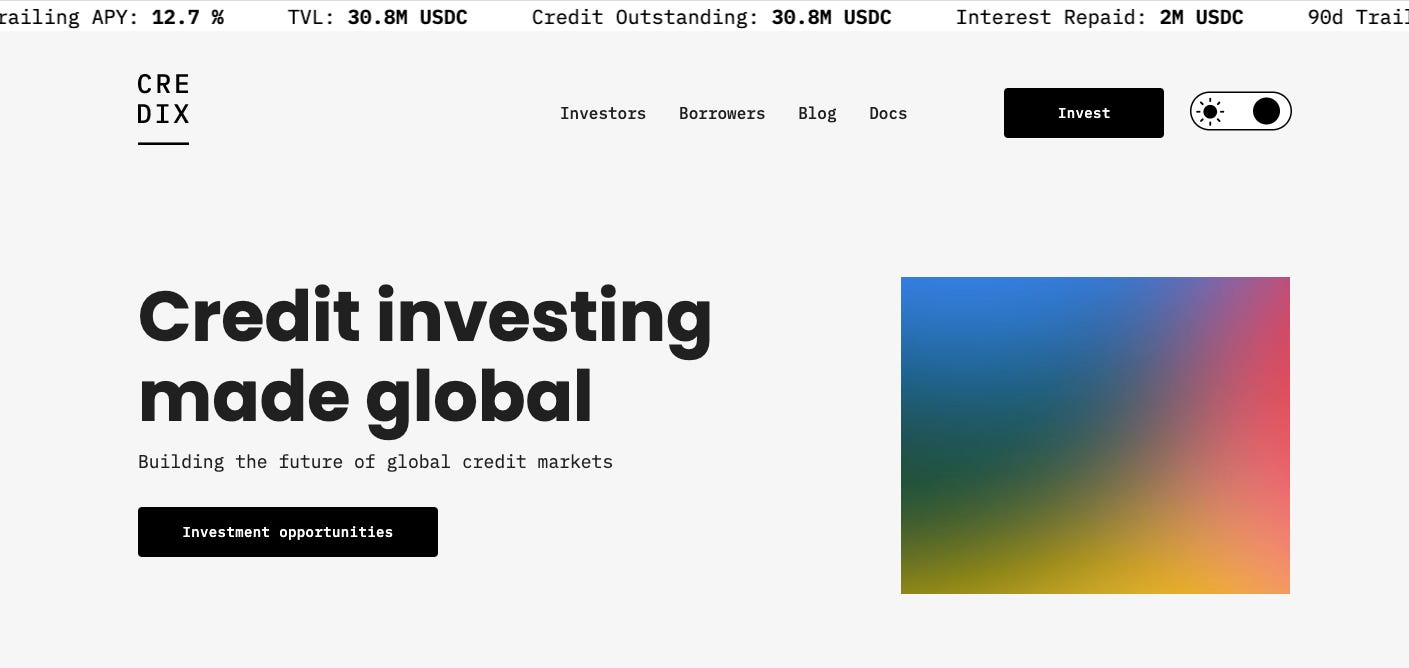

The true plug from this category, for us, is Credix Finance. Credix is a next-gen credit ecosystem, enabling institutional borrowers to access liquidity, and creating attractive risk-adjusted investment opportunities for institutional investors, credit funds, and accredited investors.

The project is built on 3 major theses, in which:

Emerging markets provide interesting investment opportunities that are currently not accessible to investors

DeFi investment opportunities will be connected to real-world assets not linked to crypto volatility

Global (financial) institutional players are seeking compliant access to DeFi

In an essence, Credix allows borrowers from Emerging markets to access credit and capital that are otherwise unavailable to them, due to potential geographic or capacity limitations. Investors have the opportunity to deploy capital and diversify returns, based on the available underwriting. Instead of relentless paperwork and hassle legacy technology, institution investors now can participate seamlessly, through the utilization of smart contracts, and blockchain’s verifiable nature by default.

Liquid Staking and MEV

Jito Labs’ introduction of MEV redistribution, through its validator client, allows for greater economic incentives and alignment, which can promptly kick off a race to liquid staking.

For starters, MEV, which stands for Maximum Extractable Value, implies on-chain activities that extract economic values, by taking advantage of market inefficiencies. On-chain, the most common activities with regard to MEV are arbitrage, liquidations, and sandwich attacks.

The introduction of Quic and Fee Market at the protocol base layer allows for better MEV capture at the current state for validators and thus could lead to the potential danger of centralization in the long run. Jito Labs, with its staking pool of jitoSOL, allow such value capture to be dispersed across various validators. Validators that run jitoSOL clients will earn additional rewards in MEV redistribution on top of the normal staking yield.

The additional rewards will kick off a flywheel demand for jitoSOL, and potentially see an increased inflow to Jito Labs’ product. As per data by Step Finance, jitoPool has already become the 4th largest staking pool by TVL on Solana within a month of launching.

The top line of the market share is Marinade and Lido, offering 7.24% APY and 7.6% APY. With JitoSOL's staking APY at 8.42%, we are expecting more migration over to JitoSOL in the upcoming months

Liquid staking provides an opportunity for capital efficiency, using the staked asset as collateral. Compared to the traditional finance system, this allows for greater participation and capital flow across the market. It's one of the great options for investors who look out for the long term, while still utilizing this network uniqueness for providing transparency P2P activities.

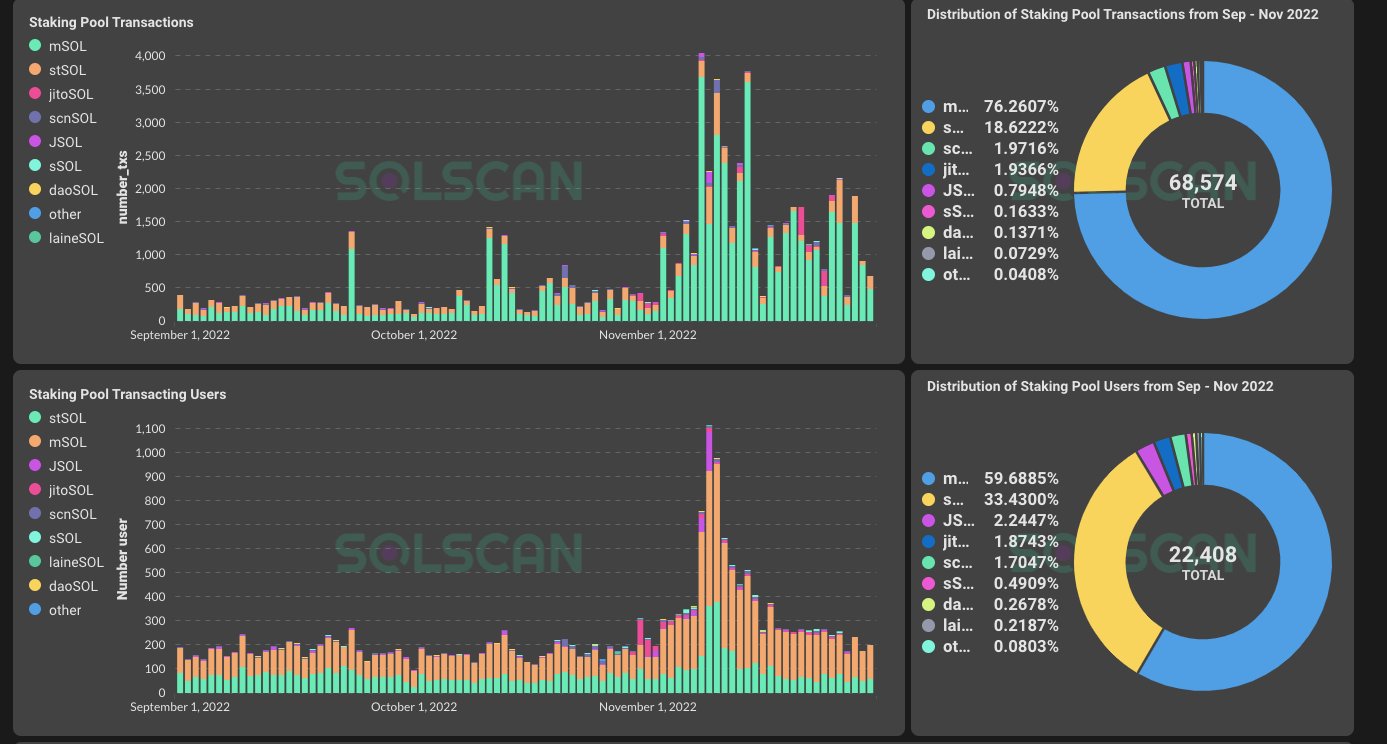

For an accurate slice of market interest for Liquid Staking on Solana, we take a snapshot between September and November for a closer look, with the data available here.

https://beta-analysis.solscan.io/dashboard/62-solana-staking-pools#theme=night

What stands out for us so far is the dominance of mSOL at more than half of the total market share, followed by StSOL. Together, the two players created a duopoly that is exaggerated by market effect, with jitoSol playing a quick catchup game.

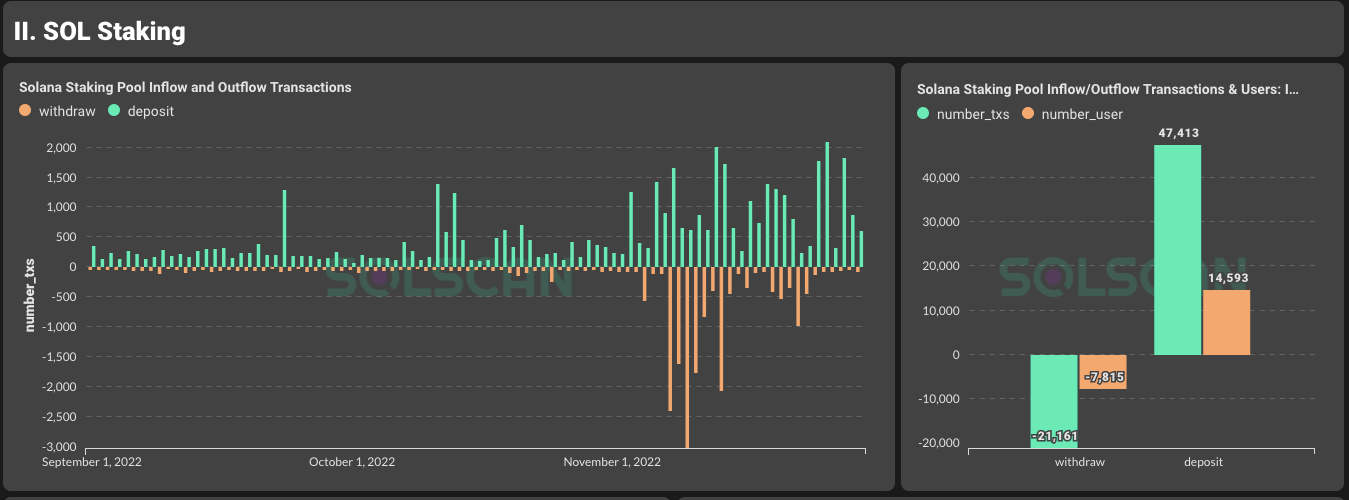

Across the board, it is important to notice that deposits are on the uptrend, the major difference is during the FTX events with unstake having a significantly higher volume during the event.

Capital efficiency with liquid staking is still underexplored areas across the ecosystem, with the only viable option being Liquid Providers for the base functions of AMMs or collateral for lending and borrowing. Further deployment and utilization across the ecosystem will help create a more sustainable inflow and demand for the product at large.

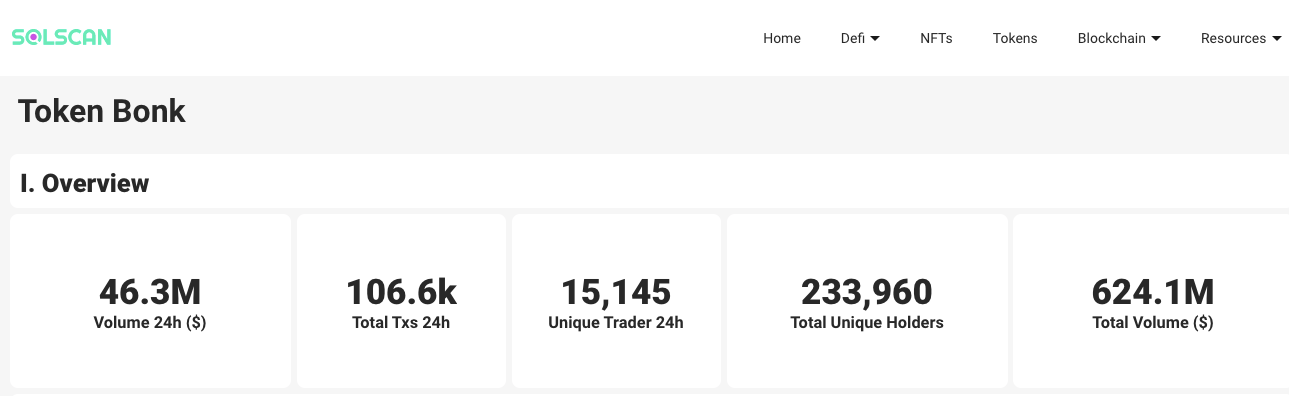

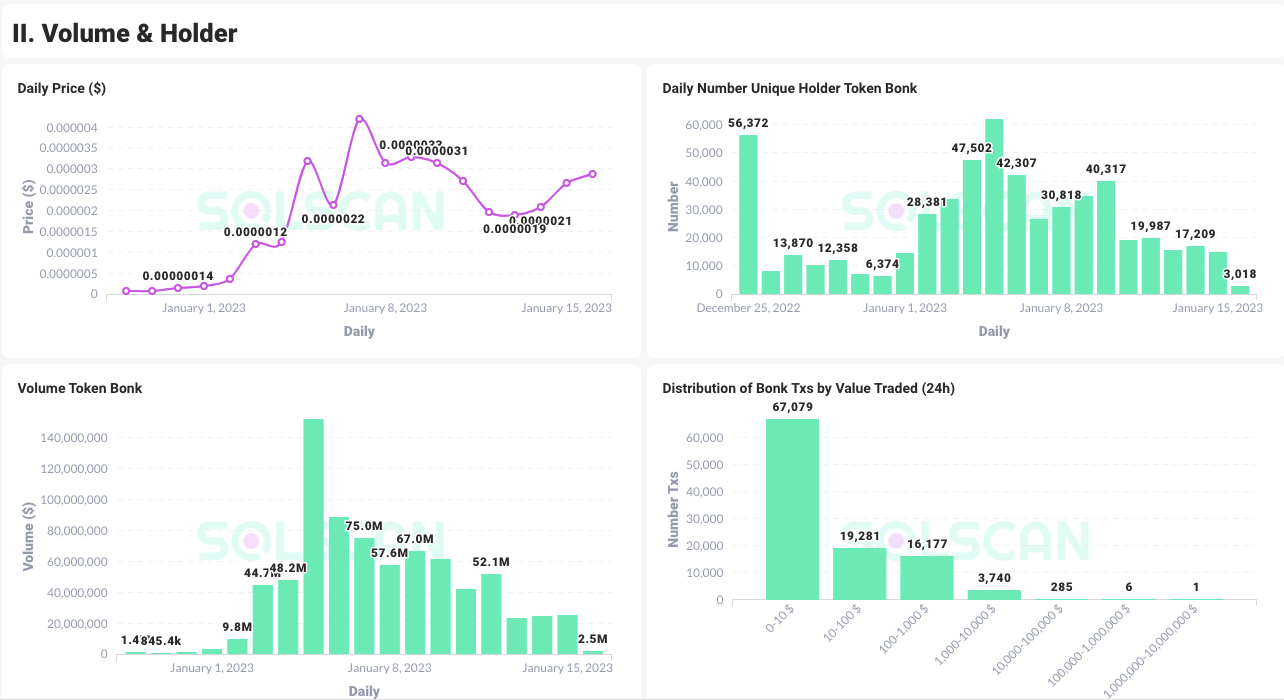

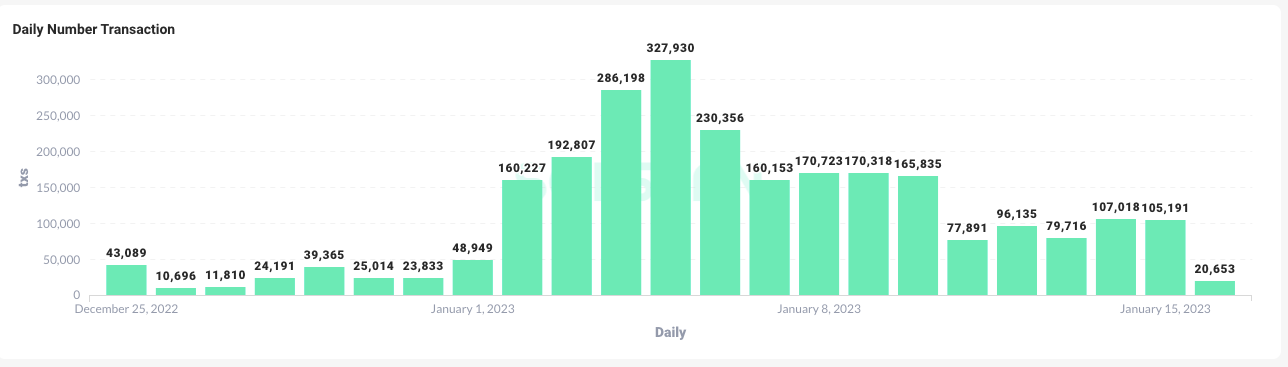

Bonk:

It’s underappreciated how big of a movement is Bonk! A meme coin, airdropped to participants within the ecosystem, spark a huge interest within the community. It's a true testament to the ecosystem, where people trade, burn (the token), and generally have a good time. A true uplift to the eco sentiment, what we’ve seen is the emergent culture of people and innovative things, as well as a remarkable feat to Solana's engineering.

The phenomenon has been covered exténively throughout our dashboard here, with some featured highlights:

https://beta-analysis.solscan.io/public/dashboard/07d0b06f-bedf-46da-91a4-09c8ba2e698a

While we won't discuss pricing here, a few interesting trends occur. First, there are several txn with a value of 100k USD and above. Secondly, Solana NFT circles for the first time interact meaningfully with Solana DeFi, as people provide LP on Orca/Raydium, Trade on Drift, and pull capital for returns across the ecosystem.

As the tech improves (as shown by birdeye_so on their trading data display), and the ecosystem matures, we will see a greater blend between DeFi and NFTs across the Solana ecosystem. This will be a crucial foundation for our next expansion into various verticals into the year.

Vibe with memes, and slowly move up to the fundamentals. Solana for the win!

Conclusion:

2022 has been a year of ups and downs, but in the end, i think that the bullish case for Solana DeFi is undeniable. The tech is interesting, the builders are gigachads, and the community stays rock solid. In the grand scheme of things, the basic building blocks, including borrowing, lending, and other financial instruments are already here, and what we need to do is communicate, educate, and innovate on top of the existing infrastructure.

Bullish, and we look forward to new DeFi milestones on Solana in 2023!