Solscan Year-End Report - NFT Ecosystem

2022 was an explosive year for Solana’s NFTs, as we have seen exponential growth in almost all performance parameters.

Solana’s NFT Ecosystem - on a rise amidst the chaos

Since its inception, Solana has garnered serious attention from many in the blockchain community for being one of the chains that supports a thriving NFT ecosystem, giving creators and users a responsive platform to design, build, and grow such unique experiences.

2022 was an explosive year for Solana’s NFTs, as we have seen exponential growth in almost all performance parameters. Despite the challenges and ramifications due to the FTX incident and the macroeconomic instability across the globe, the Solana’s NFT ecosystem was still positioned to continue growing stronger.

Prominent collections that lift up Solana’s brand name include DeGods, y00ts, OkayBear, and most recently Claynosaurz. These collections, along with the explosion of NFT Unicorn Magic Eden and the industry standard setter Metaplex, among many others, have helped Solana accomplish incredible milestones. The most recent can be seen in November, as Solana’s NFT sales reached an ATH of 6.7 million in SOL. In the long run, it will be advantageous for both them and the chain if some of these collections stick with the network that has heavily promoted them to achieve their current level of success.

In this report, we will first try to go through some of the most fundamental metrics that help measure the success of Solana’s NFTs in 2022. Then, we will focus on covering some topics that make up the Solana NFT ecosystem as it is. The first part that analyzes the 2022 Solana NFT performance and trends is broken down into three subsections: Overview of the network’s NFT statistics, Secondary marketplace performance, and Collections.

Oh by the way, here’s the link to our dashboards

Overview of Solana's NFT Statistics:

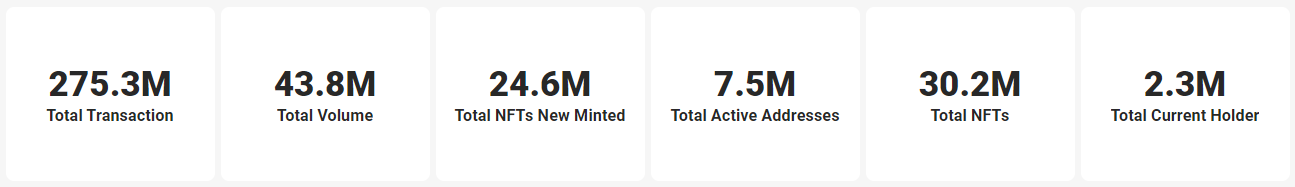

Solana NFTs achieved incredible traction in 2022. Almost 300 million NFT-related transactions were made, including direct wallet-to-wallet transactions, secondary marketplace transactions, and minting or burning transactions. The total trading volume was recorded at 43.8 million in Sol, with nearly 25 million new NFTs minted within the year, almost four-fold the figure for the total number of NFTs in 2021. As NFT supporters finally recognized Solana as the chain that supports a thriving NFT ecosystem due to its unmatched speed and negligible gas fee, total active and unique addresses skyrocketed and peaked at 7.5 million unique users.

Most importantly, despite the recent economic downturn and financial catastrophes, Solana NFT's total market capital in SOL was still rising significantly. The total market cap for the entire ecosystem (floor-price based) was at its peak of 84.4 billion SOL in December, a 70% increase since the beginning of the year.

The total number of active wallets experienced some growth in 2022. However, the chart indicates that Solana witnessed a drop in the number of users within the last 2 months of 2022, right after October, when the figure reached its highest at 2.8 million. The total number of NFTs minted through 2022 shares a similar pattern with the total number of active wallets. While the community was most active in minting NFT in September, with 3.7 million NFTs minted, the activity saw a sharp decline toward the end of the year.

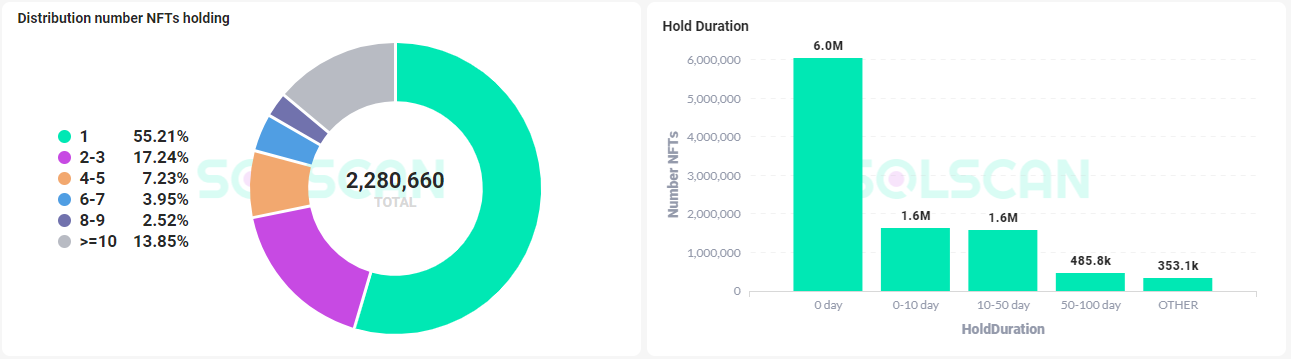

More than half of the nearly 2.3 million unique NFT holders held just one NFT in 2022. Almost one fifth of the total holders held 2 to 3 NFTs in their wallets, and the percentages decrease as the number of NFTs held within a wallet increases. However, the pie chart indicates that 13.85% had more than 10 NFTs.

As for the hold duration, most NFTs are held for less than a day, showing that the majority of NFT traders on Solana paper-handed their JPEGs. 3.2 million NFTs were held in the span of 1 to 50 days, and the figures fell rapidly as the holding length increased.

Marketplace:

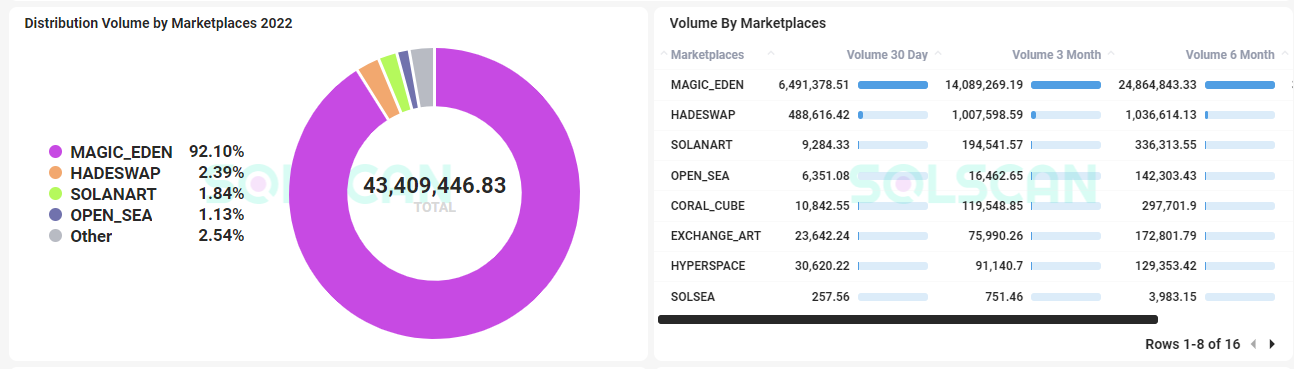

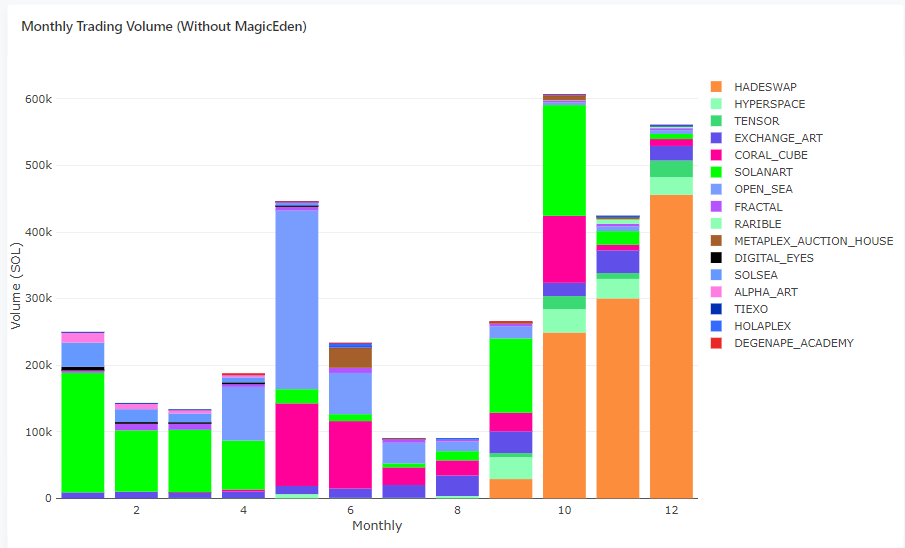

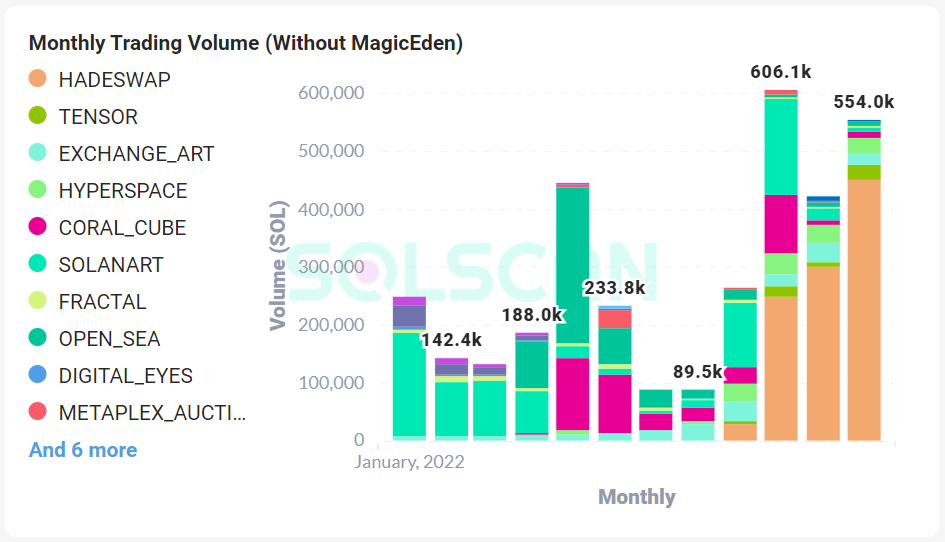

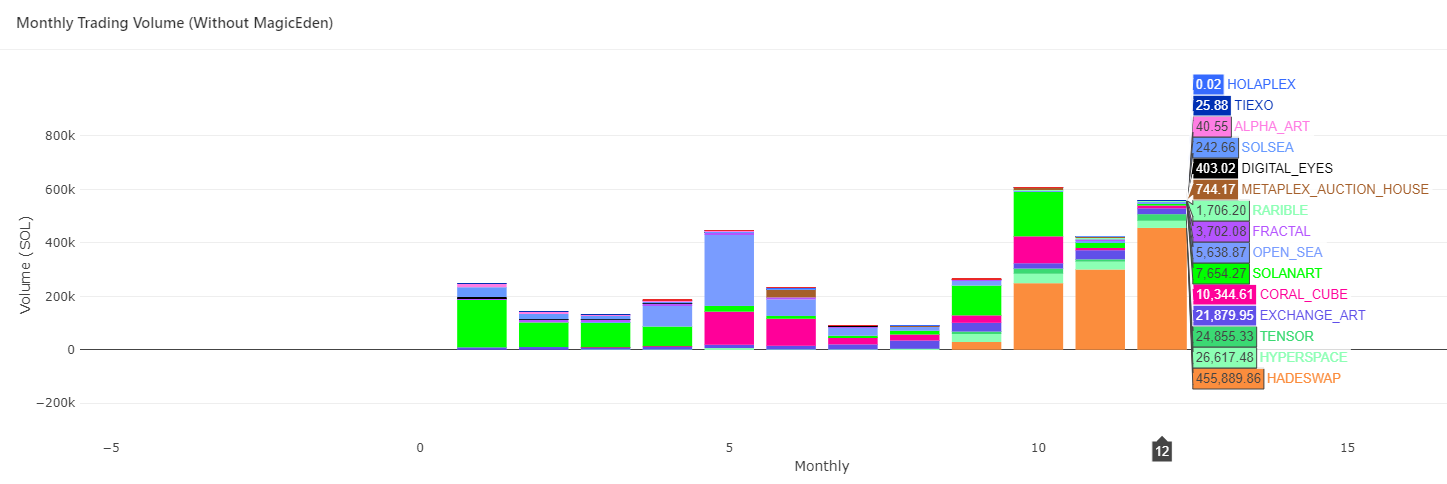

The secondary NFT market saw Magic Eden exert a strong level of dominance. Most prominent protocols accumulated a total of over 43 million in SOL over 2022. The leading marketplace was responsible for the majority of Solana’s NFT market share, accounting for over 92% of the total secondary trading volume. Although within the last few months of 2022, Magic Eden gave up some of its market share to Hadeswap, the platform still retains its position as the most prevalent marketplace on Solana. Hadeswap also advanced to second place in terms of overall volume despite being introduced in the final quarter of 2022.

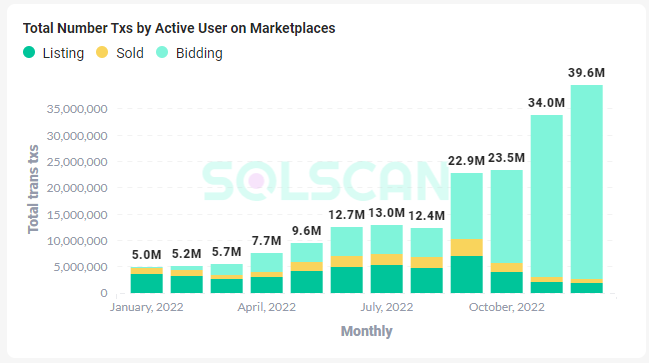

The number of transactions broken down by listing, selling, and bidding transactions is depicted by the chart above, showing that Solana NFT traders were increasingly active over time. Notably, as we progressed toward the end of the year, the marketplaces saw a huge spike in bidding transactions. To some extent, the growth in bidding activities can indicate that traders were taking advantage of the bear market, trying to bid NFTs with lower prices. However, the amount of listing and selling transactions slumping within the last few months can be interpreted that NFT holders were having hard time exiting their JPEGs without suffering too much losses.

Magic Eden:

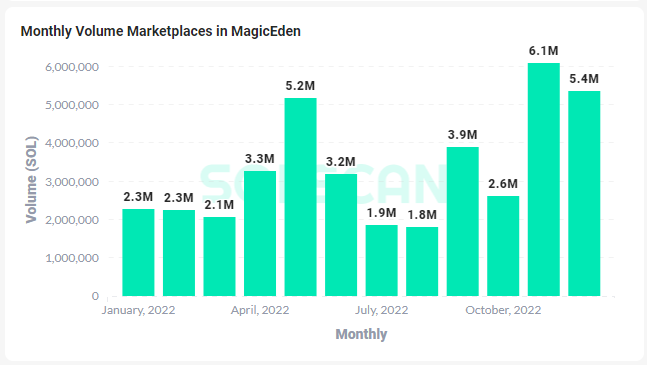

Unquestionably, Solana’s leading marketplace Magic Eden dominated Solana NFT in 2022, starting off the year with 2.3 million SOL in monthly volume, and almost tripling the figure before the year ended, amidst the times of bear market.

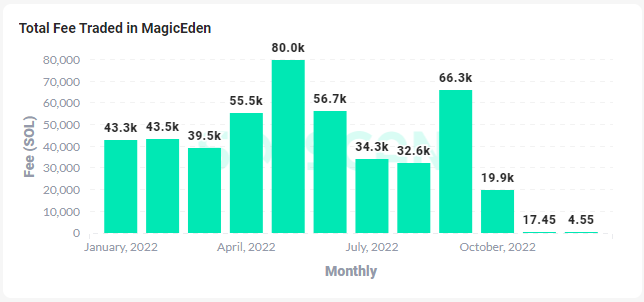

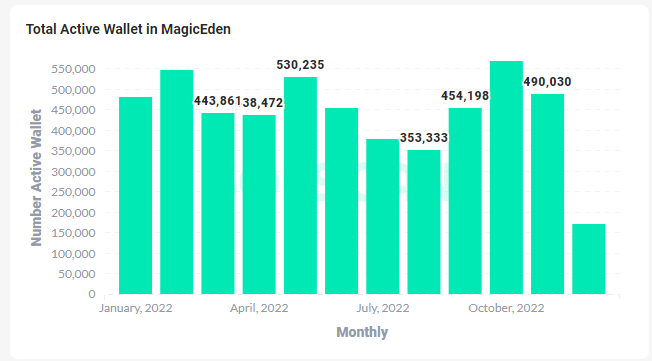

The monthly number of active traders using Magic Eden averaged out at around 500,000. The platform showed some resilience throughout the year until December. Driven by market-wide downturns, Magic Eden saw a huge decline in the number of trades within the last month of the year: 70% fewer users than the previous month.

Other Marketplaces:

Regarding other marketplaces, 2022 saw significant growth for new platforms with fresh narratives as well as consistent growth for OG marketplaces. Hadeswaps, though only launched in October, achieved substantial volume in quarter 4 as the platform brought a new form of NFT trading to the space. With a monthly average of 50k and 20k SOL in volume, respectively, Coral Cube and Hyperspace, who were positioning themselves as the core NFT aggregators to Solana, also significantly gained some market share. Before losing ground to competing platforms in May, Opensea, the Ethereum-based NFT marketplace that announced its support for Solana in April, reached a monthly volume of over 250k SOL.

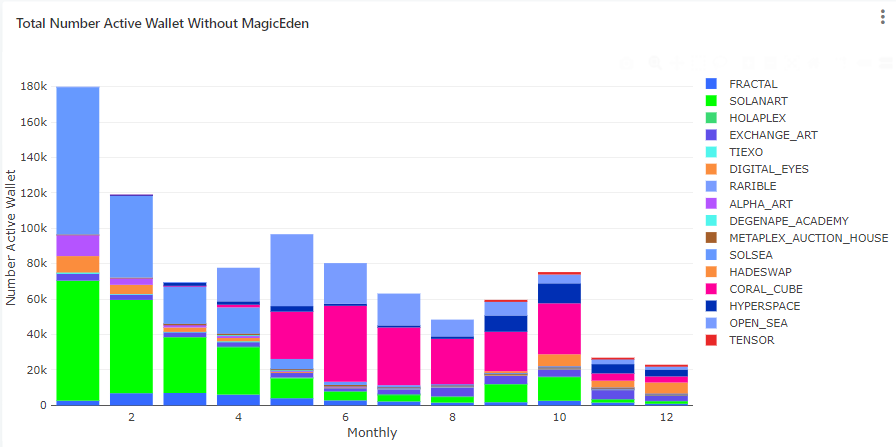

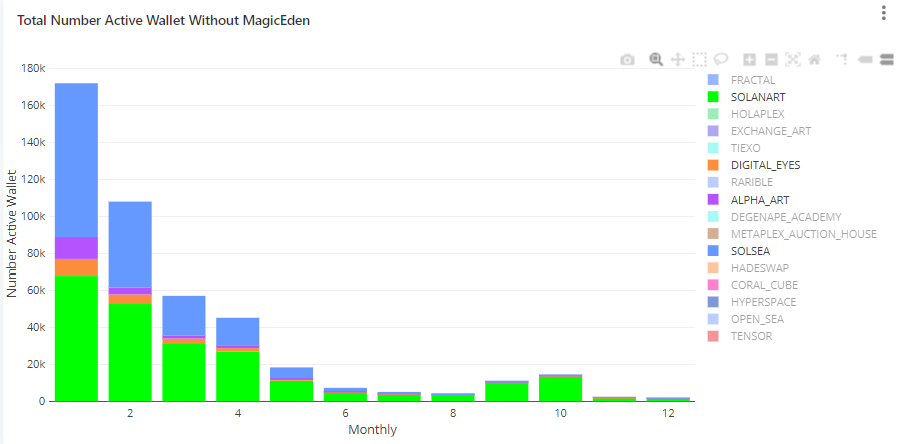

Other NFT marketplaces' user counts are shown to have decreased over time in 2022 in terms of active wallets. These platforms experienced significant losses in active users due to a variety of factors, including the emergence of newly deployed protocols and the bearish sentiments spread across the space throughout the year. Solsea, Solarart, Digital Eyes, and Alpha Art stood out as four of the protocols that experienced the greatest user loss in 2022; all of them experienced a plummet in active users of more than 95%.

On the other hand, platforms such as Hadeswap or Tensor, which brought fresh trading narratives to the NFT scene, were steadily gaining ground. Both marketplaces received a massive flow of active users within Quarter 4, especially in the case of Hadeswap, which went almost 10 times bigger in October.

Collection:

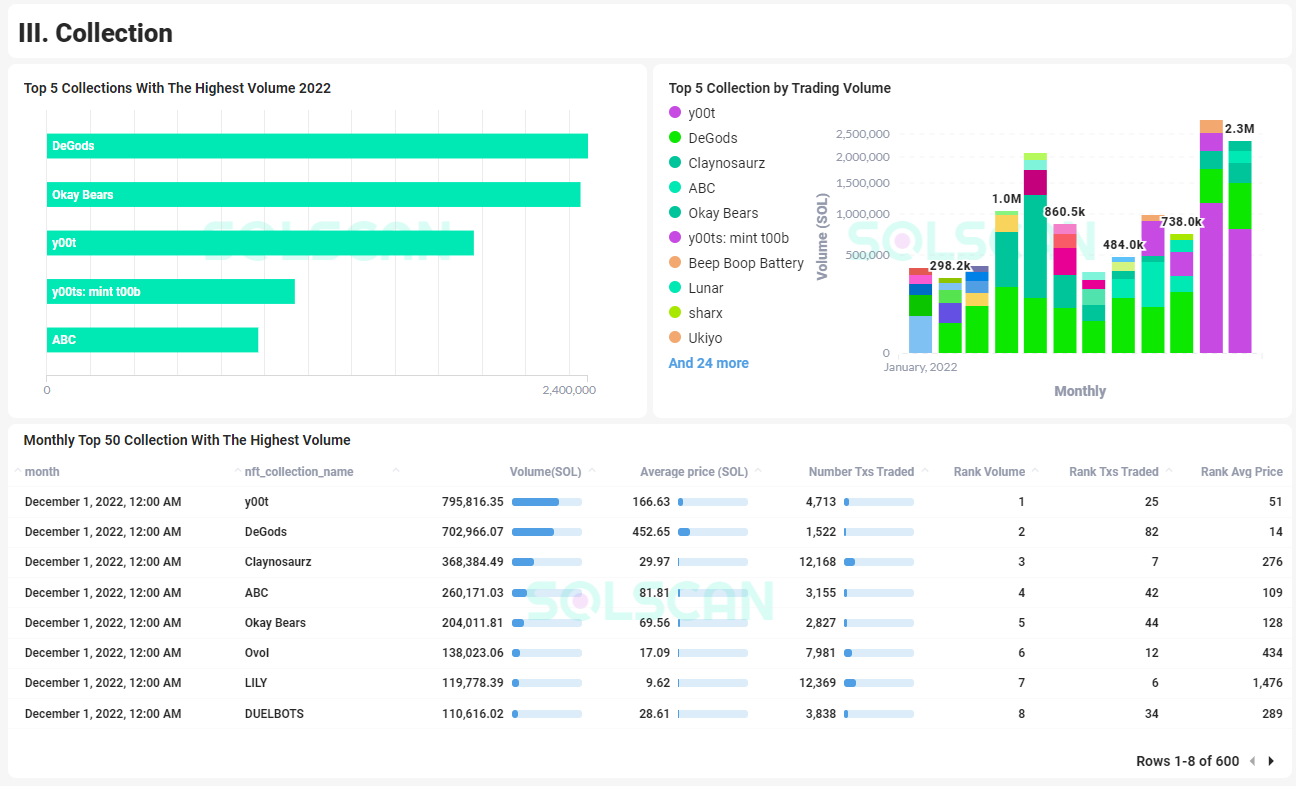

Collections like DeGods, Okay Bears, y00t, and ABC had such great performances in 2022, achieving incredible volumes in SOL, getting hyped and mentioned all over social media. Some of them even received a pretty great deal from other networks, getting enough funding to further grow their community outside of Solana.

What sets these collections apart from others is that they exemplify the principles of having great utilities, excellent narratives, and great teams behind those JPEGs and have created a strong community for their project.

Our personal picks for the best NFT collections in 2022 are: Claynosaurz, ABC, and Okay Bears. Honorable mentions include: Degen Ape Academy for consistent performance as one of the Solana OGs, Rakkudos for the protocol it represents; and lastly Cets on Creck and Liberty Square for the art and stories.

Fortunately, as opposed to Solana’s Defi sector, which stagnated due to the macroeconomic and stakeholder crisis back in November, the network’s NFT scene is still flourishing more than ever. The positive metrics truly reflect the success of Solana’s NFT Ecosystem, which is due to many contributing factors. One of the key players that has been an important contributor in building up the ecosystem that supports and thrives on Solana’s NFTs is the industry leader: Metaplex.

Metaplex - The Industry Standard for Solana NFTs

Metaplex, launched in June 2021, is the protocol and permissionless infrastructure layer for NFTs on Solana. Since the launch of this protocol, Solana has seen remarkable growth in its NFT ecosystem over the past year. It provides sets of development tools and open standards for digital asset issuance and ownership on-chain—allowing creators to bypass the technical challenges and launch their NFTs using a familiar interface that standardizes and simplifies the process of minting and configuring metadata.

Metaplex’s strength lies in primary sales and minting solutions for creators, although its solutions do support the secondary market. Until now, Metaplex has released a set of programs that suit many different purposes, from basic tools that can help creators mint NFTs (Candy Machine), for which Metaplex is best known, to programs that enable mass airdrops (Gumdrop), and other tooling stacks that serve smaller but more specific purposes.

The protocol accounts for 99% mints on Solana, creating so many standards for SPL Tokens which can be utilized for multiple purposes of functions and use cases, ranging from gaming, pfp to further explore other use cases that support the sense of metaverse. In this Q3, the deployment of new tools such as Creator Studios, enhanced compression, and Candy Machine V3 is laying the groundwork for further ecosystem expansion. In Q4, Metaplex just announced the launch of a program enforcing royalties in an attempt to protect the creators’ interests.

However, this move has triggered an intense debate among the NFT enthusiasts, saying this violates the ethos of true decentralization, especially when the update authority will then belong to Metaplex, and this, according to many tech experts, will allow Metaplex to have full control of NFTs minted through the protocol.

NFT Royalties Debate

While NFT marketplaces have historically paid out royalties to game-makers, the recent heated debate about whether such payments should be mandatory really poses the question of what this means for our industry's future. The lack of technical solutions that can enforce royalties on the blockchain without compromising decentralization has led to creators losing their financial interests, for there are NFT playgrounds that bypass the royalties.

The NFT Royalties debate started since the beginning of this bear market, and the birth of Yawww, an NFT Marketplace where users can trade NFTs without Royalties. This triggers some complaints from NFT creators, who claim that they reserve the rights to earn their share of revenue stemming from trading activities. However, the traders have their own reasons to support their opinions. Some collections even claim 10% royalties for their NFTs, and that’s eating into the sellers’ profits. The whole royalties topic raised 2 concerns that are yet to be fully resolved: coming up with solutions that can protect creators’ rights while at the same time, maintaining decentralization.

Platforms that support zero-royalty trading gained a lot of traction in a short amount of time right after the debate getting heightened, dividing the Solana NFT Community into 2 factions: one supporting the true freedom for the NFTs they own, one advocating for the consistent interests of creators that ensure a healthy, long run for the ecosystem. This leaves no choice for leading NFT platforms such as Magic Eden or Metaplex to come up with solutions regarding these issues

Magic Eden

Since the start of the debate, the team has tried various approaches to see the community’s response. Initially, Solana’s top NFT marketplace started making creator royalties optional, following the rise of rival platforms that were rapidly gaining market share by enabling royalty-free trading for users.

But as the leading marketplace that is responsible for more than 90% of the trading volume at the time, Magic Eden’s action led to a sudden rise in wash trading and price manipulation across the ecosystem. Not only did this go against their original claim that Magic Eden would always honor NFT creators’ royalties, but their abrupt movement also entailed some serious consequences.

Soon after the most dominant marketplaces already stopped forcing traders to pay royalties fees, Magic Eden made an opposite move: launching the Open Creator Protocol (OCP), an open source tool that allows creators of new NFT projects to enforce royalties. That means traders cannot bypass the royalties when trading the NFTs minted via the protocol on secondary marketplaces. Magic Eden has finally done a favor to the royalty respecting world and claimed that the team would protect creators interests with defensive measures at the protocol level. Creators can opt for banning secondary marketplaces if they refuse to enable royalties in trading. As for the existing collections and new collections that don’t adopt the protocol, royalties are still optional.

OCP provides additional features beyond royalty enforcement, including dynamic royalties and customizable token transferability. The dynamic royalties feature allows creators to specify a relationship between an NFT’s sale price and royalty amount via a linear price curve. Customizable Transferability introduced a new set of rules and actions: creators can limit trading while NFTs are being minted, or create other restrictions that can be used to gamify the trading behavior. One thing to remember is that other platforms must integrate OCP in order for collections that use this open source tool to be traded outside of Magic Eden.

Metaplex’s Solution!

In October, Metaplex hinted about deploying a new NFT asset class program through which they can finally enforce NFT royalties, amid the ongoing debate. Early December, the team made an announcement regarding their solution to the controversial issue , allowing creators to protect their royalty rights through a creator royalty program. The Metaplex’s latest program enables the creators to have full control over which marketplaces and utility programs may interact with the collection. This means creators can ensure that every sale coming from their NFTs on secondary marketplaces will be made through royalty-guaranteed transactions.

Creators of the existing collections can sign up to upgrade their NFTs while keeping their NFTs intact. Metaplex reassured NFT owners and creators who considered using

The Metaplex’s Creator Royalties Enforcement program with their announcements, claiming that the solution would entirely preserve the NFT’s provenance or the integrity of the token’s accounts.

Metaplex has taken the initiative with this new program, showing that they are proactive as the industry leader to set up a standard to honor creators’ royalties. The solution is expected to be fully rolled out in January.

Interested creators can sign up to be part of their program here

The major leaders within the industry have proposed their solutions to the problem, each contributing to the space in their own ways. However, there are still tensions between the major players over how to correctly pursue the right path. Recent accusations from both Magic Eden and Metaplex against each other have been made. The two platforms alleged that the other was taking advantage of the situation to gain dominance and control over the ecosystem by proposing solutions and measures that demonstrate centralization. In hindsight, reaching an agreement on the matter among the parties is of the utmost importance right now to guarantee a healthy, long-term development for the space in the months to come.

NFT AMM

Magic Eden took a market share hit in October, as platforms with new narratives such as Hadeswap, Tensor, Goatswap were luring traders away from it. Known as one of the most successful forks of Sudoswap, Hadeswap achieved incredible DAU and volume back in October by being among a few projects that adopted automated market making (AMM) into Solana’s NFT space. Hadeswap, along with a few other NFT AMM platforms, works similarly to AMMs on decentralized exchanges such as Raydium or Orca, creating liquidity pools in which NFTs are traded.

One of the problems with NFTs, as well as with other speculative assets, is that they may become illiquid, especially when the market sentiment is bearish. NFT AMM has been recently adopted by the Solana ecosystem for this particular reason, creating instant liquidity for your illiquid NFTs. NFT AMMs, as the name suggests, bear a strong resemblance to the traditional AMMs found in DEXs. Users can stake their NFTs, create liquid pools, provide liquidity, earn trading fees as liquidity providers, and essentially become market makers by creating two-sided pools (selling and buying pools).

Hadeswap became the second largest NFT platform on Solana by 24-hour volume at the time by launching a product that blends the mechanism of NFT trading with that of Defi. Through a variety of NFT AMMs launched on the network in September and October, Solana’s NFT Traders were introduced to a concept of selling and buying pools that allow them to dollar-cost average in and out of collections. Additionally, these pools boost convenience by easing the process of listing your NFTs and buying others’ NFTs. Users can set parameters for each pool so that NFTs are only bought and sold at a certain price. Simply put, this is actually a better way to enter and exit a collection, and this approach simultaneously enables a Defi experience on NFT platforms for traders.

NFT Lending and Borrowing platforms

Another solution that developers seek to resolve the illiquidity issues with NFTs is to provide a lending and borrowing platform for them. The landscape of NFT as collateralized loans has been quite robust on Ethereum, due to some of the network’s first mover advantages, including long history of financial exposure and strong liquidity. In light of the success that Ethereum has achieved so far, builders on Solana are shipping products that allow traders to gain quick access to liquid capital that can be obtained through NFTs.

NFT-backed loans are the latest applications to fully unlock the financial utilities of NFTs. The idea is simple: you lock up your NFTs as collateral for crypto loans. Lenders get interest by letting you borrow their funds, and you get your NFT back when you repay your loan. In case you fail to return the funds and pay the lender's interest, your NFT used as collateral will belong to the lender.

The science behind it is simple yet effective enough to help NFT owners overcome the financial limitations of their assets. NFT lending protocols come in a variety of shapes and forms. To name a few, on Solana right now there are at least 4 types of NFT Loan: Peer-to-Peer, Peer-to-Pool, Orderbook, and Fractionalized NFT ownership via DeFi applications.

Peer-to-Peer: resembles the regular crypto loans that happen directly between 2 parties. A Borrower lists NFTs as collateral with a loan offer. Their NFT is then entered into an escrow account, held by a program waiting for a lender to fund it.

Peer-to-Pool: these platforms allow liquidity providers to deposit tokens into pools. Then, the borrowers can access the liquidity within those pools by transferring their NFTs into the available vaults, locking the NFTs. The protocols assign value to the collateralized NFTs by the floor price on secondary marketplaces such as Magic Eden or Hyperspace.

Order-book: Orderbook-based solutions for NFT Loans are quite rare on Solana. The order book model stores all the offers for a specific collection and connects a borrower available in the book. The prices of collateralized NFTs are also determined by the floor prices across the ecosystem.

Fractionalized NFT: Fractionalization for NFT Ownership is a little bit different from the above types. NFT owners can deposit their NFTs to a vault of a particular collection, in exchange for an amount of fungible tokens (a type of derivative product) that can be used across Defi protocols.

Conclusion:

2022 was a huge year for Solana’s NFT in terms of growth, transformation, and overcoming obstacles. The network started off 2022 with confidence in making a huge leap forward through its NFT space, and ended the year with Solana’s enthusiasts believing more than ever in the future of the chain’s NFT ecosystem.

Notably, 2022 also witnessed some huge shifts in NFT trading and markets. There were a lot of emerging platforms with novel mechanisms that began gaining traction. Solana’s largest traditional secondary market - Magic Eden still outperformed its competitors in 2022. However, the team must have definitely taken seriously the emergence of other trading platforms (NFT AMMs) which bring other forms of NFT trading to the table. In a period where bearish sentiments mostly persist, a shift in customer behavior is evident. Users would have to switch to other forms of trading that offer them better opportunities to maximize their exit chances and profits. Therefore, leading protocols that want to maintain their positions need to act accordingly to better fit the situation.

The answer to the problem regarding royalties is still nerve-racking, as protocols are still figuring out a solution. Honoring royalties continues to be the best way to guarantee a robust NFT ecosystem, as creators are sufficiently motivated to continue delivering stunning collections with great utilities. However, almost all of the suggested solutions rely on centralized methodologies. These solutions need to be modified in order to guarantee that NFTs maintain their integrity and the true spirit of decentralization. The key players within the space should make collective efforts to resolve the problems while putting the interests of creators and the community first.

In 2022, the protocols that support the financing use cases of Solana's NFTs were rapidly expanding. We hope that these protocols will achieve some huge milestones on the path toward making better NFT financing platforms for users. Despite all the negativity that tried to bring down the Solana community’s spirit, we can always find a way to navigate through this bear market. The JPEG scene on Solana may encounter some obstacles at the moment, but it always finds a better reason to thrive later on.

MyQR_2023-07-12_14.25.33.jpg - Print